Disney is looking to sell its TV assets. Bob Iger built Disney into a top entertainment company by acquiring Pixar, Marvel and Lucasfilm. Now he’s looking to downsize in a big way. Apple, with its focus on sports deals for Apple TV+, may be eyeing Disney’s ESPN.

Thomas Buckley and Lucas Shaw for Bloomberg News:

Iger put roughly a third of the company up for sale this week, declaring Disney’s linear TV assets noncore. That includes TV networks ABC, FX and Freeform. He also said Disney is looking for a strategic partner for ESPN — though he’s not willing to sell the whole thing — and the company is already looking to sell or restructure its TV and streaming business in India.

It’s a stunning if inevitable turn of events for an executive who spent so much of his career working in TV, and for a company that relied on cable networks for the majority of its profit… Yet the accelerating decline of cable TV has limited Iger’s options. He thought he’d solved this problem with Disney+ and Hulu, his two mass-market streaming services. But his streaming business is expected to register a loss of about $800 million in the company’s just-ended third quarter.

Management chased streaming subscribers at unsustainably low prices to goose the launch of Disney+ in 2019 and is now seeking to raise prices without alienating customers. (Disney+ lost 4 million subscribers last quarter.)

Iger put up a for-sale sign during an interview with CNBC in Sun Valley, Idaho, home to an annual summit of the media and tech elite organized by the investment bank Allen & Co… Iger’s CNBC interview was unmistakably a distress signal.

Most of the potential suitors for linear TV networks are financial entities, like private equity firms, that would milk them for cash as they decline into obscurity… The list of interested parties in ESPN is longer, and could include tech giants like Apple, as well as sports companies like Fanatics… Rumors have long swirled that Iger will end up selling all of Disney to Apple. It’s still hard to imagine Iger selling Disney to anyone. He was always a builder — not a seller. But Bob the builder is doing a lot more cutting this time around.

MacDailyNews Take: We live in interesting times.

See also:

• Apple should buy Disney to feed Vision Pro – analyst – June 7, 2023

• Is Apple looking to make a big acquisition? – April 6, 2023

• Why Apple would want to buy Disney – April 4, 2023

• Apple should buy Disney – analyst – March 30, 2023

• Apple in talks with Disney, others on VR content for upcoming ‘RealityOne’ headset – January 23, 2023

• Apple TV+ hires Disney+ exec Ricky Strauss as new head of marketing – January 3, 2023

• Bob Iger: Apple and Disney would have merged if Steve Jobs lived longer – December 21, 2021

Please help support MacDailyNews. Click or tap here to support our independent tech blog. Thank you!

Support MacDailyNews at no extra cost to you by using this link to shop at Amazon.

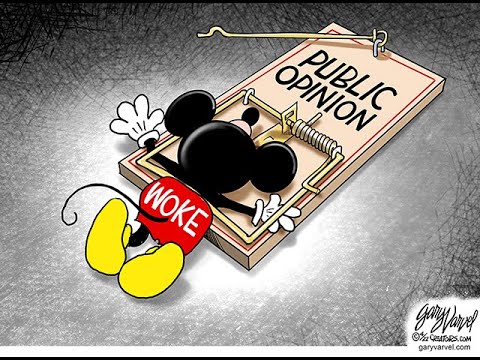

DIsney: Get woke, go broke.

Same thought posted at the same time… LOL!

nuff said…

First Then and Go Woke, GO BROKE…nailed it!

Sorry, but that ship has sailed….and sunk.

This is… bizarre. My understanding is that ESPN is an absolute cash cow.

But yeah, the whole ESPN strategy of making me pay for ESPN through my cable service provider fees AND then also charging for ESPN+ which has DIFFERENT exclusive content and does NOT include much of the cable ESPN live sports is maddening.

I though I would be able to most of my live sports and cut the cable by subscribing to ESPN+ but that is entirely wrong idea.

Also having two separate streaming services with HULU and Disney, is so irritating. Just ditch the Hulu brand, and put it all under Disney.

Also, most of the Disney Star Wars mini-series spin-offs have turned into classic examples of how to squeeze two hours of content into 8-10 hours. Very poorly written.

Let’s review—

ESPN is the golden cash cow. Disney will KEEP ESPN. They will do some sort of licensing VisionPro Apple TV bundle with a subscription bundle.

I guarantee it.!!

Remember Iger was part of the VisionPro unveiling. Cook and Iger are buddies. Disney and Apple will do a joint venture. ESPN is one of the last pieces of good news in the Disney Cabal at this point…..

Thank me later.

Hadn’t realised ‘Bob the Builder’ had made such an impact in the US, obviously not on the Disney channel mind, which would have been a nice irony.

Apple doesn’t need to buy ESPN or any of Disneys tv channels. Apple needs content not brands. If Apple wants the TV media rights to sports they can just go to each league and offer more more then most of their content competitors. Now, you could say Apple needs to buy Disney for its IP and existing content, then that makes total sense. But don’t make phony stories up about ESPN being bought by Apple. The execs within Apple are smarter than that. The headline should’ve have been, “one of the gabbling sites should be buying ESPN.”

This has nothing to do with ABC being “woke,” whatever today’s definition may be. The “linear” broadcasting business is dead in the water. All of it. ABC is just the first to say out loud what a lot of folks have been saying privately. Today’s sophisticated marketing doesn’t want to pay for a mass-market reach when they can get better results through targeted, individual ad buys, and probably end up paying a lot less.

The same way that national magazines and big city papers can’t compete with the internet for ads, today’s tv stations (and the broadcast networks) are walking anachronisms. Here’s another analogy: local stations are at the same point as Blockbuster was shortly after download speeds and server infrastructure allowed movie downloads at the push of a button.

Honestly, the most valuable things stations (and networks) have to sell are their radio spectrum bandwidths and their brand names.

Forgot to add the obvious: Apple should not — and would not — buy a legacy network any more than they’d buy a factory that produced CRT monitors or 56K modems. It’s dead technology

This has EVERYTHING TO DO with ABC being “woke,” whatever the definition may be that escapes you. Being woke vastly accelerated the DECLINE in earnings and market share, Bud Light, anyone?

As to the rest of your post, I tend to agree…