When Apple Inc reports results on Wednesday, Wall Street expects flat fiscal fourth-quarter sales and lower full-year revenue compared with the prior year, mostly because of declining iPhone sales. Yet Apple’s stock price has hit all-time highs in recent weeks, as has its price-to-earnings valuation.

Investors and analysts told Reuters that much of the explanation lies in Apple Chief Executive Tim Cook’s skillful management of relationships in Washington, Beijing and Wall Street.

Cook has fostered a relationship with U.S. President Donald Trump, dining with him and conveying Apple’s views on tariffs and U.S. manufacturing. He has also kept strong enough relations with Chinese officials to avoid Apple’s becoming a target of explicit retaliation after the U.S. government moved to cut off Huawei Technologies Co – Apple’s arch rival in the premium smartphone market in China – from American technology.

MacDailyNews Take: It’s a tough tightrope to traverse (of course, Cook gets paid very well to walk it), but so far, so good. There are issues with Apple’s stance on human rights versus kowtowing to Chinese authorities over Hong Kong (too many instance of hypocrisy will corrode Apple’s brand), but overall, Cook’s high-wire act is working well for Apple shareholders.

Tim is vastly overcompensated for being a spineless fence sitter. It will not bode well for Apple’s future.

The article states:

“Apple’s share of the Chinese market fell to 5.2% in the calendar third quarter versus 7% a year ago, while Huawei, which sells many more low-cost models than Apple does, saw its market share surge to 42.4% from 24.9% the year before, Canalys data showed.”

This indicates that no matter how much Cook kowtows to Xi, the Chinese market will remain dominated by Party-chosen winners. (Similar to what the US administration wishes it could do).

Moreover, Marketwatch isn’t so optimistic. Apple’s media play can’t show any profit for at least a year or more, new Macs are AWOL, and Timmy’s incremental updates to existing products aren’t going to deliver growth in a slowing economy:

https://www.marketwatch.com/story/apple-earnings-iphone-optimism-hasnt-changed-apples-downward-trajectory-2019-10-25

“Despite a recent stock rally, estimates suggest Apple’s full-year profit and sales will decline for only the second time since 2001.”

The Marketwatch article also nicely plots historical analyst estimates versus actual results — something on which MDN’s naysayers of company analysis surely will want to comment.

Hmmm. Record 4th quarter says you and Marketwatch clearly don’t have a clue….about anything – other than spineless carping from the margins of irrelevance.

@ Gotcha: The 4th quarter hasn’t happened yet and 3Q2019 was hardly better than last year.

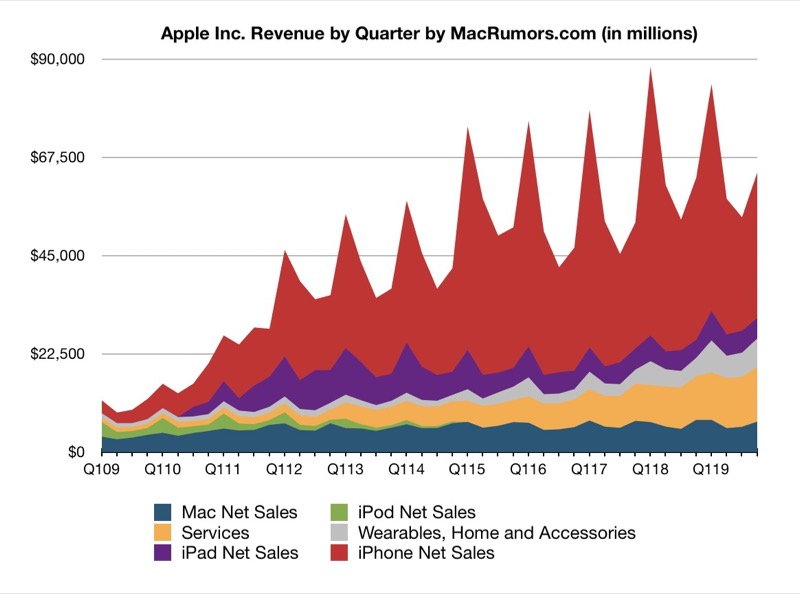

Is Macrumors an acceptable source to you? Look for yourself:

Apple in 3Q2019 took in revenue of $64B versus $62.9B last year — a whopping 1.7% increase. Yeah, that’s a new 3Q record. Whoopee. Shall we all retire and build in-ground swimming pools for our gold coins? If your wage earnings increase from the last year were the same as the inflation rate, you would not be jumping up and down bragging about how you “Beat the Street”.

But there is more. For the full fiscal year, however, revenue and profit is DOWN in 2019 versus 2018. Apple generated $260.2 billion in sales with $55.3 billion in net income YTD, compared to $265.5 billion in sales and $59.5 billion in net income for Q1-3 fiscal 2018. Apple themselves revised 4Q2019 expectations down. It’s not clear overall 2019 will be an earnings growth year at all.

I know it’s unpopular to set the record in perspective here on Apple & Politics Hype Daily, but someone’s got to call an incremental gain what it is. Moreover, investors need to understand that relatively flat sales are a big part of why Cook is now playing Wall Street games. AAPL stock price is goosed by stock buybacks. If it wasn’t for that, higher growth NASDAQ components would be blowing Apple stock performance out of the water. CEOs are conditioned to make stock price look good even when slow incremental hardware updates is all they can manage to offer.

I would rather see Apple grow due to the strength of its products. Many of us here have lamented that Apple isn’t firing on all cylinders yet. The Mac especially is a sore point.

Of course other factors come into play too. As I mentioned many times before, Apple has largely given up on business and institution markets to focus on consumer discretionary products, all disposable, and all made in China. This leaves them exposed to rising business costs, among them Con Don tariff threats that have still not hit hard.

Lastly, 3Q tepid growth is basically what every company has reported. Could it be that the magical best ever economy in the history of forever not all it’s hyped to be? 3-6% economic growth is simply not happening at Apple or in the US economy at this time, as The Chosen One promised. Trickle down didn’t work. The oligarch class, Timmy included, pocketed the vast majority of the tax savings, while future taxpayers have trillions in additional debt to pay off in the future. But we digress…