Apple’s iPhone users remain the most loyal smartphone owners around even after seven years of vicious competition from Samsung: People who buy one iPhone are far more likely to purchase another.

Analysis into brand retention across smartphone manufacturers by WDS, A Xerox Company, shows that 76% of Apple customers replace their iPhone with another iPhone, while 34% of all consumers switching device brands settle for Samsung.

WDS, a specialist in customer care solutions for the mobile industry, conducted more than 3000 interviews with smartphone owners in three flagship smartphone markets; the U.S, UK and Australia. The data forms part of the company’s annual WDS Mobile Loyalty Audit, a global study of loyalty in the mobile industry.

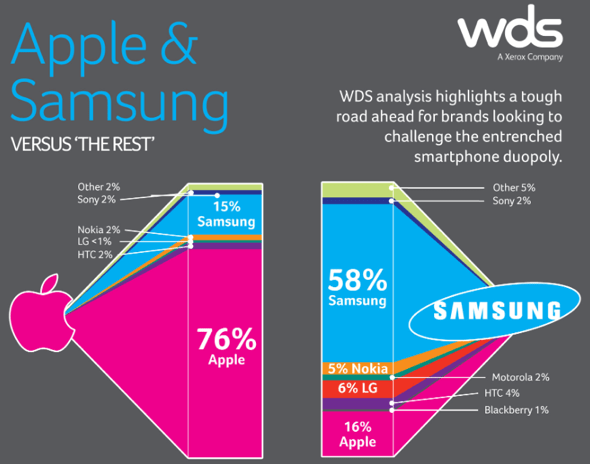

Brand retention (customers who replace their smartphone with another from the same manufacturer) is led by Apple and Samsung. WDS found that Apple retains 76% of its customers, followed by Samsung (58%). No other smartphone manufacturer managed to keep brand retention above 40%.

Brand retention and share of migrating customers (source: WDS, A Xerox Company. 2013)

Analysis into device upgrade trends reveal that Apple dominates with 76% of customers who upgrade from iPhone to another iPhone while Samsung trails with just 58% retention.

Source: WDS

Who knew there were so many people in the world willing to pay for stolen IP? Oh, wait. Right. I’ve seen it. Many street corners in Manhattan you can see the same thing. People picking up copies of DVDs on the street for pennies on the dollar because they’re copies.

Most customers don’t care about product history, they just want a product that meets their needs at a low price.

Apple is clearly the winner here, but Samsung is doing extremely well as number 2. Their losses to Apple (16%) are barely more than Apple’s losses to Samsung (15%). It is Samsung’s Android competitors that appear to be on the ropes.

As a business Samsung is in great shape, given that their only large competitor Apple is not actually trying to compete with them in the mid/low range at all.

If anyone can come up with a credible scenario where Samsung loses in that situation, I would like to hear of it.

As always, in the end, Quality prevails !!!

Precisely, quality and functionality. I’ll never buy an apple product again!

Australia has just over 23 million people and Canada has over 35 million people yet they say that Australia is a flagship market? Canada has one of the world’s highest user ratios of Apple products. What gives here?

Haven’t you heard? Canada is the USA 51st State according to Apple statisticians.

And they thought Puerto Rico would be the 51st State.

Booooo. Never. :-). (Proudly Canadian)

Canadians are too proud to become the 51st State. However . . . we are gullible enough to have the US become the 11th province.

Bigger than Prince Edward Island, smaller than the North West Territories, the USA could fit if it didn’t have such a Stupendous National Debt.

Canada — America’s hat.

“Analysis into brand retention across smartphone manufacturers by WDS, A Xerox Company, shows that 76% of Apple customers replace their iPhone with another iPhone, while 34% of all consumers switching device brands settle for Samsung.”

Is it just me, or is this comparison total BS?

I could buy 75% of Apple and 34% of Samsung, or 75% or all consumers for Apple vs 34% of all consumers for Samsung, but listing the numbers this way makes the comparison “incomparable”.

I can be a fanboy just like the next guy, but comparisons like this are just a lie that is an all-too-obvious attempt to make Apple look better than it really is while achieving just the opposite effect.

Are you aware that Xerox is a contractor for Verizon?

I am not questioning the numbers themselves, only the way they have been compared. Whomever wrote this article took one number from one column in a table and compared it against a second number in a different column. Those numbers, while not independent, are not directly comparable.

The article should compare 76% against 58% or 24% against 34%.

Another thing that could be compared are the 15% and 16% numbers from the barographs (percentages of Apple users switching to Samsung versus percentage of Samsung users switching to Apple). Even those numbers are directly comparable as (apparently, world-wide) there are more Samsung users than Apple users so Samsung’s 16% is actually much bigger (in absolute numbers) than Apple’s 15%.

Regardless of how poor the actual numbers might be (coming from a biased source), the article totally misuses those numbers.

What I have seen is that many of those who “switch” from and iPhone to and Android phone, do so only for a short time.

I’ve personally have known a few who have switched and then switched back within weeks. Of those, many did so because to them the larger screen was a benefit. But even though that was the reason they switched, it was not enough to keep them from switching back to an iPhone.

I don’t need or want a larger screen but I do see a need for Apple to offer a larger screen for those which dexterity issues, fat fingers or in many cases poor eye sight (even though the larger screen is not necessarily clearer or easier to read).

I can’t see how it would hurt sales but I do see it increasing sales to elderly groups.

Why would I even consider a non-iPhone. They’re all crap. Yes, I’d like a slightly larger screen iPhone, mostly for when I use it as a GPS. I’m patient enough to wait every two years between upgrades. Come fall, I’ll hopefully be signing a new two year contract for a slightly larger screen iPhone 6. Never once, nor will I ever settle for second best from Apple’s competitors. There’s just no comparison in the quality of the hardware and software.

“There’s just no comparison in the quality of the hardware and software.”

In your opinion maybe, in practice there are other great phones out there with hardware or software features that either an iPhone does not have or are much better.

I don’t get why this is anything to crow about really. All but 22% of those Samsung users would just jump to another Android phone, which effectively gives Android a 78% retention rate as a platform against iOS’s 76%. These are rounding errors when it’s put that way. Roughly three quarters of users of both platforms are happy, one quarter are still looking for the one that best suits them.

The relative proportion of Apple iPhone to Samsung Android “replacement customers” is 31% (ie, 76% ÷ 58%). For every 131 Apple iPhone owners who buy another iPhone as its replacement, only 100 Samsung Android owners bought another Samsung brand as its replacement. But don’t forget there are fewer Apple iPhone owners than Samsung owners. We must therefore multiply the percentage switchers (by brand) by the number of persons due for replacement (by brand) in a given period to understand the impact in terms of the absolute number of switchers (or device sales) for each brand.

Here is a hypothetical example. Let’s assume there is 1 Apple iPhone out there for every 3 Samsung phones. Then for every 1,000,000 Apple iPhones that come due for replacement, 240,000 (ie, 24%) are lost to another brand — let’s presume Samsung. And of 3,000,000 Samsung phones that come due for replacement during the same period, 1,080,000 (ie, 36%) are lost to another brand — let’s assume Apple iPhones. For every customer that switches from Apple to Samsung during the period, there are 4.375 Samsung customers who switch to iPhone. If Apple started with 1,000,000 customers, it lost 240,000 to Samsung but gained 1,080,000 from Samsung, and ended up the period with 1,840,000 customers. (Apple would have seen a net increase of 840,000 iPhones over the 1 million installed base it started with, representing an 84% increase over its “replacement base”.) If Samsung started with 3,000,000, it gained 240,000 switchers from Apple, but lost 1,080,000 customers to Apple, ending up with a total of 2,160,000 customers. (Samsung would have seen a net loss of 840,000 customers from its 3 million installed base it started with, representing a 28% decrease in its “replacement base”.)

The above calculations are for example only. The 1-to-3 ratio of installed base numbers for Apple iPhone v Samsung Android phone is a guess. I read that the Apple iPhone installed base in 2010 was 4%, compared with Samsung’s 21%, representing a 1-to-5 ratio. But I presume the ratio has declined since then, which is why I picked 1-to-3. If someone has better information on relative installed bases by brand, or better — the actual number of replacement phones coming due every year — then they could do a more accurate analysis.

Analysts: start your engines !

Your biggest problem is that you don’t know the difference between a Smartphone and a feature phone.

In other words, an iPhone is a Smartphone but 90% of Samsung phones are feature phones or burner phones.

Your dubious math is a total waste of time.

I agree: the phones are not comparable. But even just looking at unit numbers (as many so-called analysts do…) reveals that the impact of switching rates is a lot more favorable to the iPhone than might be inferred from the article alone, which does not consider unit numbers by brand. This was my only point.

I also agree that it would be informative to see someone do a formal cost-benefit analysis of mobile phones that incorporates qualitative differences in device attributes and features, as well as costs (including full life cycle costs). Maybe our discussion in this forum will motivate someone to conduct one? That would be a worthwhile exercise, and could help many consumers make a better-informed purchase decision.

However, I disagree that estimates such as the above are a total waste of time. It is perfectly legitimate to make estimated calculations to indicate the magnitude of impact, or even just the direction of trend, that might be relevant to an analytical issue that has been overlooked. Again, the main point of the above little exercise was that the switch rate data imply a much larger impact when unit numbers are considered.

Over and out.

The analyst proudly presents his 3000 survey results for a population of more than 250 millions. Well that’s is some accuracy for you!!!

Offhand, a survey size of 3000 nevertheless looks to be a reasonably large sample size for statistical inference purposes. The accuracy is probably fine. A more important issue is for the sample to be representative of the larger population of interest. If you are familiar with political polls, the sample sizes can seem very small (relative the larger populations of interest they are applied to). Yet the margins of error implicit in the seemingly small poll samples turn out to be reasonably narrow. So as long as the sample is reasonably representative of the population, the accuracy of the estimates is probably fine.

Ok, so the chart represents only 3 markets and since there were 3000 respondents I suppose a sample size of 1000 per market. I’d say that is a pretty small sample size with the added problem of selecting 3 heavily Apple dominant sites to make the comparison. We’re being asked to assume that the 1000 persons per market have also been selected as representative of the whole of each respective market. Kind of reach for me.. 😛